Foreign investors have been selling off Indian financial assets even before the Hindenburg Adani incident, Wall Street's prior bearish outlook on the Indian economy is evident. This selling trend along with the decline in the value of Indian equities has been attributed to a perceived conspiracy to harm India's economic steadiness.

Reports from research firms have often been used by Wall Street short sellers to attack companies in other countries. These reports typically highlight a target company's weaknesses and potential risks focused to cast it in a negative light.

On 24th January 2023, Hindenburg Research released a report alleging various financial and environmental irregularities by the Adani Group. Despite the group's denial of the allegations few report has resulted as increased controversy. In which the opposition demanding a Joint Parliamentary Committee or a judicial probe into the matter. Hindenburg Research is known for its aggressive short selling tactics, targeting companies it believes are overvalued for potential profits.

This event has reignited debates on the role of short sellers in the financial markets and their impact on targeted companies.

While short selling can be a profitable strategy for organizations it can also have a significant impact on a country's economy. Several examples illustrate how reports from firms such as Citron, Muddy Waters and Glaucus have caused significant drops in stock prices resulting in ripple effects on their respective countries stock markets.

For instance, Citron accused Valeant of inflating its revenue and profits using specialty pharmacies and engaging in aggressive drug price hikes. The release of the report caused Valeant's stock price to lose nearly half of its value within two weeks leading to a decline in Canadian stock market and affecting other Canadian pharmaceutical companies.

Similarly, Glaucus accused Blue Sky of overstating its fee-earning assets and questionable accounting practices causing its stock price to plummet by almost 60% and affecting the Australian stock market. Moreover Muddy Waters accused Sino-Forest of overstating its assets and revenue leading to its stock price falling by nearly 80% and causing ripple effects on the Canadian forestry industry and stock market.

While these short selling reports are often controversial still their impact on targeted companies can be significant as a result causing declines in stock prices and in some cases it leads to bankruptcy. This can stall a country's economic growth and create financial distress. Therefore, the Hindenburg Adani incident could also have potential economic consequences for India.

Wall Street Sold India's Financial Assets in Secret Prior to Adani Hindenburg Quarrel

Wall Street was aware of the potential growth and success of India's economy and they saw this as a threat to their own financial dominance. These companies devised a plan to tank the Indian economy by orchestrating a massive short-selling campaign aimed at the nations corporate titans.

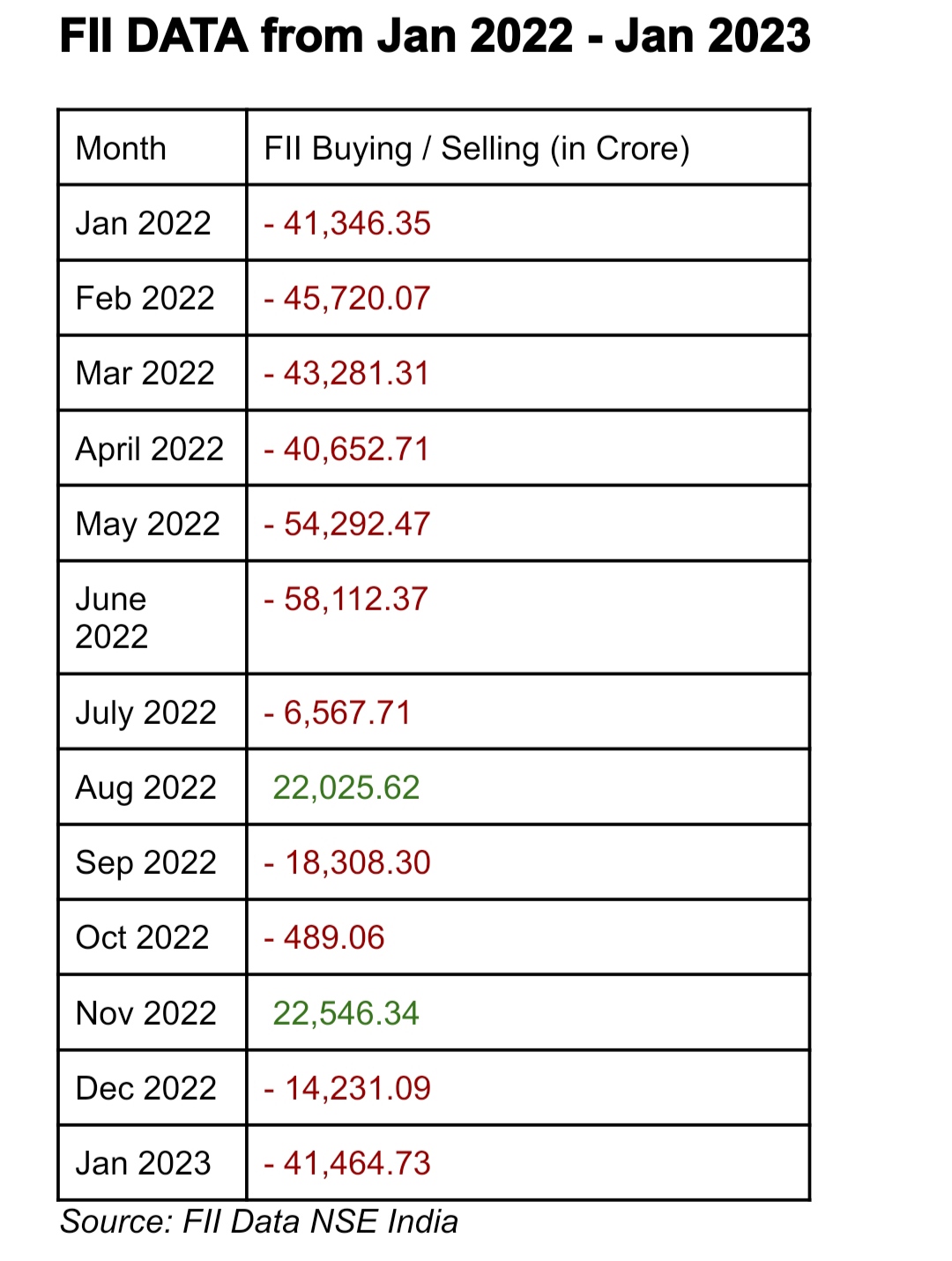

Over the past nine months, Foreign Portfolio Investors (FPIs) have been heavily selling their investments in the Indian financial market. According to National Securities Depository Limited, FPIs have withdrawn a massive amount of Rs 255,879 crore ($33.5 billion) from the equity market and Rs 16,621 crore ($2.1 billion) from the debt market resulting in a net outflow of Rs 2,71,950 crore ($35.6 billion) from October 2021 to June 2022. During the first half of this calendar year, the total net outflows reached Rs 227,290 crore ($29.7 billion).

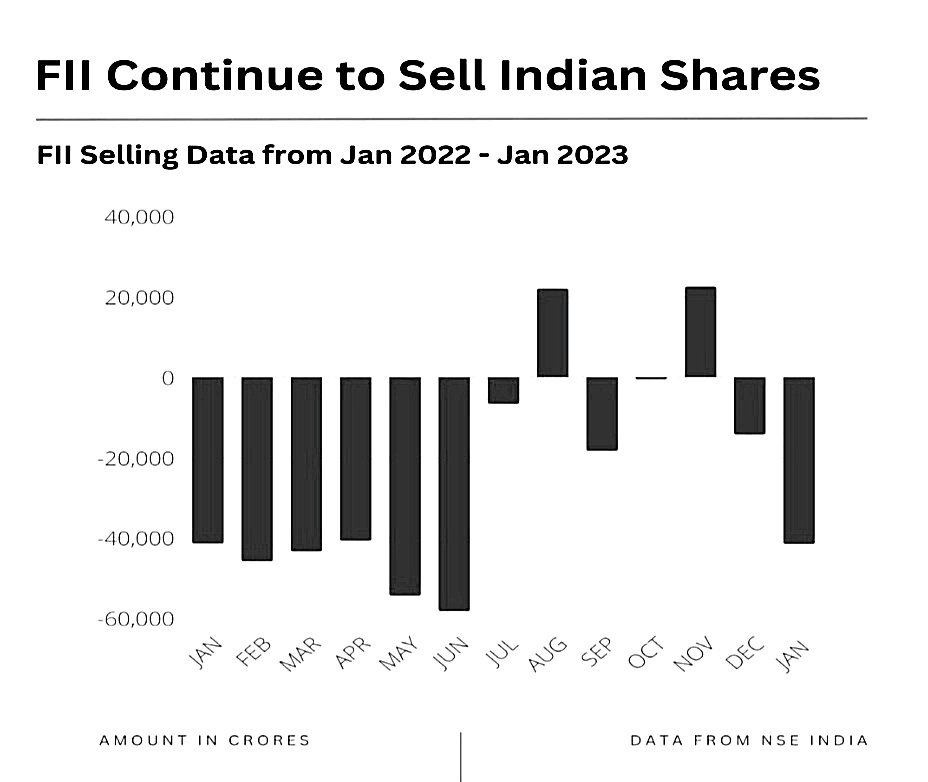

Data Chart

In the last three decades this is the longest consecutive monthly selling streak observed in the Indian stock market that is surpassing even the 2008 global financial crisis. The FPIs have mainly been selling off assets in the financial services, information technology and capital goods segments which constitute the bulk of their holdings.

This recent selling spree by FPIs represents the fifth significant episode of sudden stops and reversals in capital flows in the last 15 years, following the 2008 global financial crisis, the 2013 "taper tantrum," furthermore normalization of US monetary policy in 2018 and the onset of the COVID-19 pandemic in early 2020. However, the current outflow volume is much higher than in previous instances potentially amplifying financial vulnerabilities and aggravating overall macroeconomic instability.

Over the period, Wall Street firms such as Goldman Sachs have taken a bearish view on the Indian economy as demonstrated by their recent downgrade of Indian equities to 'market weight'. Other foreign brokerages after including Morgan Stanley, UBS and Nomura have also downgraded India's rating due to concerns about expensive valuations, rising COVID-19 cases and potential tapering of the US Federal Reserve's stimulus program.

Goldman Sachs has presented a pessimistic outlook on India's progress in prediction that the nation will experience its deepest recession as a result of COVID-19 lockdowns. The firm expects negative growth of (-5%) for FY 2022 with a rebound of 20% in the third quarter. Projections for the fourth quarter and the first quarter of the following year remain unchanged at 14% and 6.5%. Timothy Moe of Goldman Sachs also suggested that Indian markets may not outperform global peers in 2023.

Other foreign brokerages have also expressed bearish views on India's economy and downgraded their ratings. Morgan Stanley as an example downgraded Indian equities to "equal-weight" from "overweight" in September 2022, citing concerns over economic lifting, rising COVID-19 cases and potential tapering of the US Federal Reserve's stimulus program. UBS also cut its rating on Indian equities to "neutral" from "overweight" due to concerns over economic growth and rising COVID-19 cases. Similarly, Nomura cut its GDP growth forecast for India for the fiscal year 2022-23, citing rising COVID-19 cases, slow vaccination rollout and lack of fiscal support from the government.

These downgrades demonstrate that Wall Street firms were not conspiring to secretly sell India's financial assets but rather were responding to concerns about the Indian economy based on market and economic data. The downgrades and bearish outlooks were not unique to India as many countries and regions have experienced similar downgrades and concerns due to the ongoing pandemic and related economic challenges.

Reasons behind Wall Street’s well planned short selling of India

India's stance on the Russia-Ukraine War and its purchase of Russian oil has caused concerns in the United States for a variety of political and economic reasons. The US has imposed sanctions on Russia due to its actions in Ukraine and India's neutral position including purchase of Russian oil could be seen as indirectly supporting Russia, contradicting the US stance.

However, as one of the world's largest producers and exporters of oil, the US views India's purchase of Russian oil as a potential threat to its oil industry and economy. The US is keen to safeguard the strength and competitiveness of its oil industry and the purchase of oil from Russia by India could potentially undermine this.

The US also has concerns about the impact of Russia's influence on India as a result of its oil purchases. The US strives to ensure that its allies and partners align with its policies, objectives and India's purchase of Russian oil could be perceived as a challenge to this goal.

Wall Street’s planned conspiracy to derail the Indian economy has had several effects on India

The economy of India was significantly affected by the massive outflow of capital and the selling off of Indian stocks by foreign investors which led to several negative impacts. Firstly, we see failing stock prices were the most obvious effect of the outflow of capital. As foreign investors withdrew their assets the value of investments held by Indian citizens and businesses decreased resulting in a decline in consumer spending.

This decrease in consumer spending led to a rise in unemployment as businesses made less profit and were forced to lay off employees or close their doors entirely. The vicious cycle continued as the unemployed had even less money to spend which further decreased consumer spending.

The massive outflow of capital also had an adverse effect on government revenues. As the economy slowed down, tax revenues decreased, which can force the government to cut spending on crucial programs and services, or to increase taxes that will respond slowing the economy. To counteract the effects of the outflow of capital, the government may increase spending, leading to an increase in government debt which can decrease confidence in government and economy.

In 2022, foreign investors withdrew over Rs. 255,879 crores ($33.5 billion) from equity and Rs. 16,621 crores ($2.1 billion) from debt segments of Indian financial markets, resulting in a total net outflow of Rs. 2,71,950 crore ($35.6 billion). This caused a significant drop in the stock market's value and a decrease in investor confidence leading to a slowdown in the Indian economy.

As published in a World Bank report, the Indian economy grew at just 7.7% in the fiscal year 2022, compared to the previous year's growth rate of 10.9%, largely due to the massive outflow of capital and the selling off of Indian stocks by foreign investors and FIIs.

Moreover the massive outflow of capital and Wall Street's selling of Indian stocks had far reaching negative impacts on India's countable growth including falling stock prices, decreasing consumer spending, rising unemployment and decreased government revenues. Therefore, crucial for the government and other stakeholders to take action to address this issue and restore relaxation to the financial markets.

.jpeg)